Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

The Search for Portfolio Stability in the Era of ZIRP

August, 2020

After years of muted volatility, the first quarter of 2020 was a stark reminder that equity markets are, by their very nature, cyclical and susceptible to steep declines. The -34% peak-to-trough decline in the S&P 500 Index from February 20th to March 23rd was less notable for the size of the decline (sixth-deepest bear market) than it was for the speed of both the decline (33 days) and the recovery (103 days). The swift recovery was, in part, a byproduct of the massive, unprecedented response by the Federal Reserve to support functionality in the credit markets, which were all but locked up in mid-March. Much has already been written, and certainly there will be more analysis to come, dissecting the extent and impact of the Fed’s response to the COVID-driven economic and market stresses.

Such policy analysis is outside the bounds of this paper, but the impact of these policy actions is particularly relevant. The Fed has pinned the federal funds rate and the short end of the yield curve effectively at zero, while suppressing longer-term yields via bond purchases. Collectively, these actions have been characterized as yield curve control. As a result, the yield on the U.S. 10-year Treasury note has been hovering in the neighborhood of 60-70 basis points, which all but guarantees a negative real return over the life of the bond. The Era of ZIRP (Zero Interest Rate Policies) is officially here and has significant ramifications for investors:

- Fixed income has traditionally served as the primary source of portfolio stability due to its key characteristics of low volatility, capital preservation, and limited correlation to equity-oriented strategies. Bonds have just two components of return – yield and price (driven by changes in interest rates or credit spreads).

- With interest rates at historically low levels, there is an asymmetric risk of rising interest rates and the corresponding material loss of bond principal.

- Low interest rates have also contributed to higher multiples across other asset classes like growth equities and real estate, making investment portfolios increasingly vulnerable to higher interest rates.

- In contrast to fixed income, multi-strategy portfolios access multiple sources of return, independent of traditional equity and fixed income markets.

- With interest rates at these levels, multi-strategy portfolios offer structural advantages vis-à-vis core fixed income as a source of portfolio stability and real return.

- Aviation adage

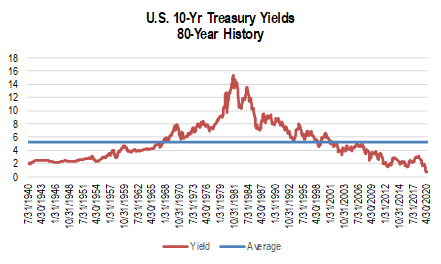

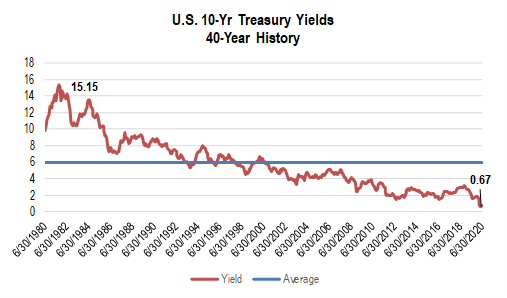

The baseline expectation for a bond return is its starting yield – this is the return a bond will generate in a stable interest rate environment. As bond prices and yields move inversely (interest rate sensitivity), a decline in interest rates will increase the price of bonds and boost returns, which has been the case for several years now. Bond yields have actually been in decline for about forty years from double-digit yields in the 1980s, culminating in the first quarter plunge to historic levels.

Chart 1

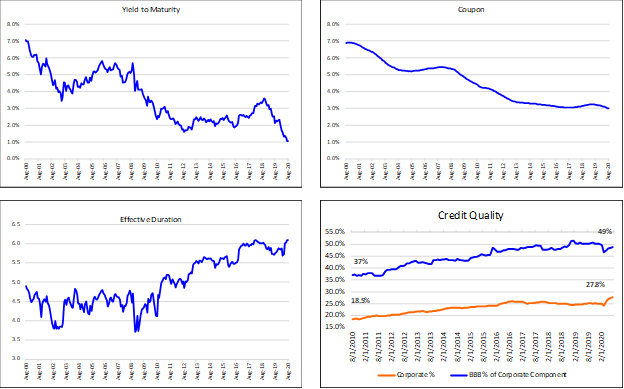

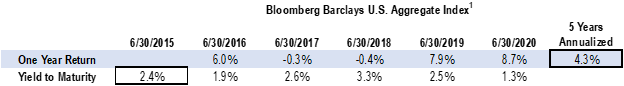

The table below illustrates the impact of declining rates on the return of the Bloomberg Barclays U.S. Aggregate Index (“BBg Aggregate”), the most common fixed income portfolio benchmark. This Index has returned 4.3% annualized for the past five years from a starting yield of 2.4%. Declining interest rates have rewarded bond holders with an excess return of nearly 2% per year, or 10.8% cumulatively. The same math also works in reverse – rising interest rates detract from starting yields and reduce returns.

Small changes in interest rates from these levels will make a big difference in relative yields and bond prices. In fact, there is a non-linear relationship between bond prices and interest rates (convexity). As an example, compare two 30-year Treasury bonds, one issued at a 5% coupon and the other issued at a 0.5% coupon. A 1% increase in interest rates would reduce the price of the 5% bond by -14%, while the same 1% increase would reduce the price of the 0.5% coupon bond by -24%, nearly double the decline in price. As bond yields approach 0%, there is almost no room to decline further, resulting in an asymmetric risk of rising interest rates and surprisingly large losses in bond portfolios.

Think of the bond market as an airplane. It was flying high and fast in the 1980s, fueled by double-digit yields. For the last forty years, this plane has traded altitude for even more speed, before taking a daring dive towards the ground in 2020. From this low altitude, tiny corrections result in major changes in altitude and, just as importantly, these changes happen at a faster rate. From here, there are two unpleasant choices: either fly dangerously close to the ground at a very low speed or climb back to a safer altitude at an even slower speed due to the drag of gravity. The ride is about to get bumpy with little progress toward the ultimate destination, and a passenger would be well advised to bail out of the plane or risk buying the farm.

We started off this missive with a reminder that equity markets can and do sell off quite sharply at times. This creates the need for portfolio stability, particularly for portfolios that must meet regular spending outlays. So, where should investors seek this stability now that interest rates have approached their practical minimums? We suggest that a well-constructed multi-strategy hedged portfolio has a number of structural advantages over traditional fixed income. First, while fixed income has limited sources of return, a multi-strategy hedged portfolio by definition has many potential sources of return, and its engine can be dialed up or down depending on the prevailing risk/reward relationship.

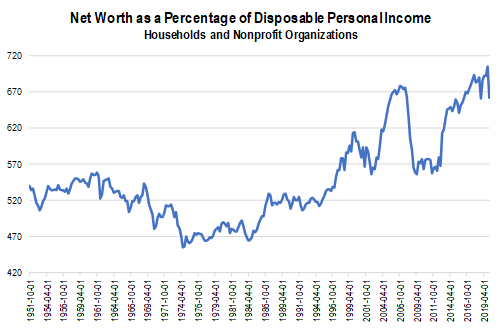

Second, a strategy with low sensitivity to interest rates will be beneficial in a time of rising interest rates as shown above. While interest rates are tied most directly to bonds, they also impact the values of many other securities. Real estate and equities, especially growth stocks, are long duration assets and have benefited from the decline in interest rates. We see this in the growth in net worth as a percentage of disposable income (funds available for savings) over the last forty years. This suggests that there is a good deal of interest rate risk embedded in investor portfolios.

Low interest rates and disinflation seem firmly in place for now, but what are the future consequences of the massive debt issuances by both sovereign and corporate borrowers, much of which currently sits on central bank balance sheets? There is certainly historical precedent for a different regime – the previous forty-year period (1940 to 1980) was nearly the polar opposite with steadily rising interest rates and negative real returns on bonds. Over the entire eighty-year period, the yield on the 10-year Treasury note has averaged 4.5%, a far cry from today’s 0.6-0.7%.