Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

The AI Revolution: Balancing Promise and Peril with a Diversified Portfolio

July, 2024 | Rich Johns and Tanner Baker

“Accelerated computing and AI are the most consequential technologies of our time … A new industrial revolution has begun. Soon, every industry will be transformed.”

– Jensen Huang, CEO of NVIDIA

“AI remains top of mind for companies and investors, with potentially the biggest TAM [Total Addressable Market] in history at stake and the trajectory of the technology still to be charted.”

– Chase Coleman, Founder of Tiger Global Management

The promise of the Artificial Intelligence (“AI”) revolution is immense, echoing the transformative impacts of past technological leaps—such as desktop computers, the internet, mobile technology, and cloud computing. AI's rapid ascension and potential to revolutionize industries and generate unprecedented economic value is becoming increasingly apparent. A recent McKinsey & Company report underscores this potential, estimating that generative AI could boost global profits by $2.6 to $4.4 trillion annually. This same report also estimates that by 2030 approximately 30% of all hours worked will be assumed by AI, highlighting its profound impact on productivity and efficiency.

To this point, the excitement and capital influx surrounding the AI revolution have largely coalesced around a handful of major technology firms. NVIDIA, the exclusive supplier of the most advanced chips essential for AI implementation, has been the most notable beneficiary. Positioned as the ultimate shovel maker in this AI gold rush, NVIDIA’s critical role has elevated it to one of the world's most valuable companies.

The price of entry to provide AI services is unprecedentedly high. AI research and development demands substantial resources, including extensive data repositories, deep pockets for large financial investments, and highly specialized engineering talent. Only a few companies possess the necessary scale to meet these requirements, primarily Microsoft, Meta (Facebook), Amazon, Apple, and Alphabet (Google). These hyperscaler technology companies maintain formidable competitive moats that seem to deepen every year. AI is not new for the hyperscalers; they have been investing in AI for decades, enabling them to deploy their extensive resources effectively and achieve positive returns on investment.

For example, Meta (Facebook) highlighted at their annual investor day in June, "AI is already helping us meaningfully improve engagement and ads ranking, and we're seeing a lot of that upside already.” Moreover, during their first quarter earnings call, they revealed that revenue flowing through their AI-powered digital advertising tools has more than doubled since last year.

The strategic advantages and effective resource deployment by these hyperscaler technology companies have translated into outsized profit generation and subsequent returns. The Wall Street Journal reported that in the first quarter of the year the Magnificent Seven experienced a 52% increase in profits, compared to an approximately 9% decline for the remaining 493 companies in the S&P 500. Notably, NVIDIA alone has been responsible for 30% of the S&P 500’s 15% return this year. When combined with the rest of the Magnificent Seven, these companies accounted for well over half of the index’s performance. Controlling for the outsized influence of the hyperscalers by equal weighting the S&P 500 resulted in performance of 5% through the first half of the year.

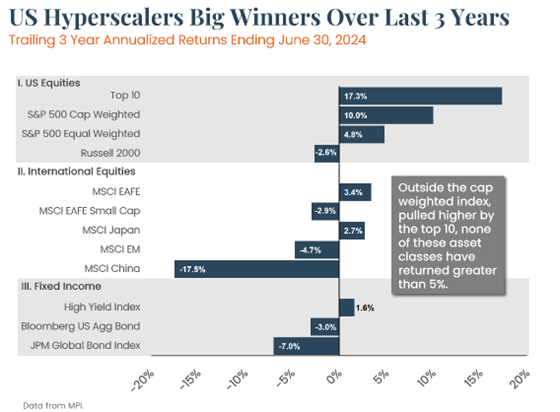

The investing exuberance surrounding AI and its beneficiaries has obscured how sparse returns have been outside of these hyperscalers. Diversified portfolios are traditionally composed of various asset classes, each serving as a crucial building block. However, as illustrated in the table below, unless you had the golden building block—the hyperscalers driving the S&P 500—as your sole investment, your portfolio likely underperformed in comparison.

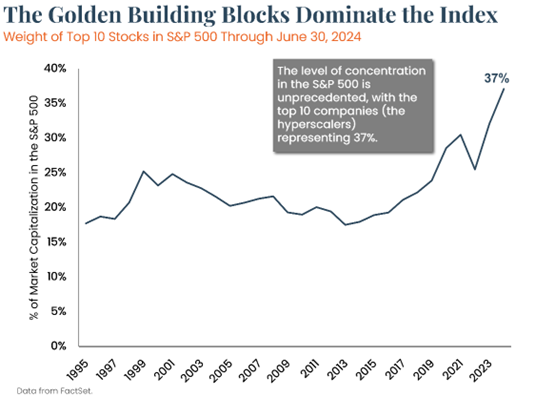

So, where does that leave us now? With 37% of the S&P 500 concentrated in a single bet, there’s a significant dependency on the AI train being unstoppable. Although S&P 500 investors may believe they have a diversified investment across 500 stocks, the reality is quite different. As seen in the chart below, this unprecedented level of concentration is historic and possibly represents the financial event of our generation.

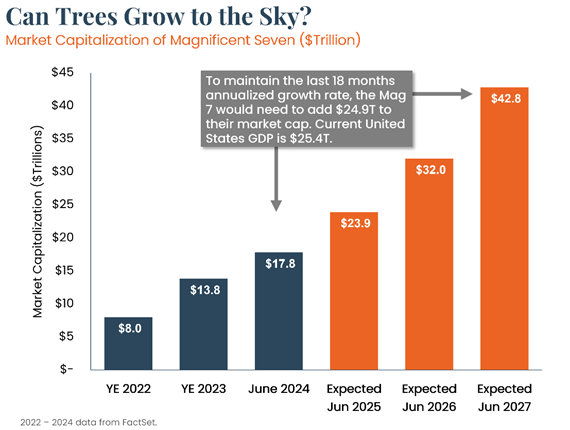

While the promise of AI is immense, the law of large numbers suggests that continued exponential growth in market value could be unsustainable. If the annualized growth rate seen in the last 18 months was to continue for three more years, these companies would need to add a staggering $25 trillion to their market capitalization—a figure equivalent to the current U.S. GDP. Trees do not grow to the sky, and it might be equally unrealistic to expect the market cap of these companies to continue their exponential growth indefinitely.

As the share prices of these hyperscalers have soared, their valuations have risen well above historical averages, making them susceptible to a pullback. Moreover, Dow Jones MarketWatch recently reported that data from its June Bank of America Global Fund Manager Survey shows the “Long Magnificent Seven” trade has kept its spot as the most crowded trade for the 15th month in a row, adding to the potential for a market correction. Risks include a capex arms race where billions are spent just to maintain competitiveness, the threat of government/antitrust regulations in the U.S. and abroad, and the precedent of first movers losing out to later entrants (e.g., Yahoo to Google, MySpace to Facebook). The speed of innovation in AI could lead to new approaches that are more amenable to smaller companies and nimble startups, which could significantly increase the number of AI beneficiaries. Outside the hyperscalers, the average stock trades at nearly half their valuation. Small cap, value, and non-U.S. equities are the cheapest relative to the cap-weighted S&P 500 they have been in 20 years and could benefit as the market broadens.

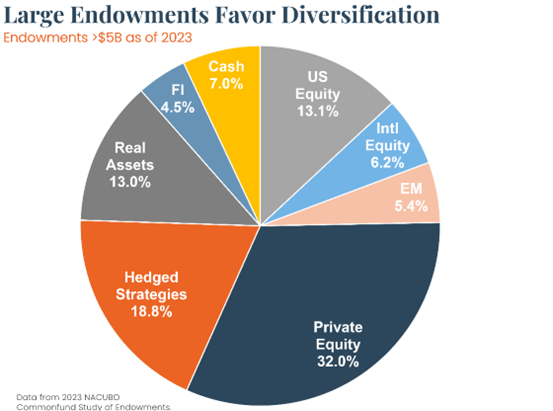

Relying on picking one golden building block—the hyperscalers—to construct your portfolio epitomizes a fragile investment strategy. In the event the hyperscalers don’t grow to the sky, investors should have other bets in their portfolios. Observing some of the largest endowments highlights the importance of diversification, as their portfolios are comprised of many different building blocks that are designed to respond to different market forces.

In his latest memo entitled The Folly of Certainty, Howard Marks writes:

... maybe Voltaire said it best 250 years ago: Doubt is not a pleasant condition, but certainty is absurd.

There simply is no place for certainty in fields that are influenced by psychological fluctuations, irrationality, and randomness. Politics and economics are two such fields, and investing is another. No one can predict reliably what the future holds in these fields, but many people overrate their ability and attempt to do so nevertheless. Eschewing certainty can keep you out of trouble. I strongly recommend doing so.

We couldn’t agree more. The uncertainty surrounding the future of AI presents at least two plausible outcomes. This AI wave may take its place alongside the housing and internet bubbles, or it could truly be one of the most pivotal innovations since the Industrial Revolution. By acknowledging the inability to predict the future, prudent investors seek to have some exposure to winners in any scenario and avoid the risk of being overly dependent on a single outcome. Constructing a portfolio with a broad base of diverse building blocks provides stability and helps ensure that investors are positioned to weather market shifts and uncertainties. This is the Gerber Taylor approach.

July 2024

Rich Johns and Tanner Baker